With online banking, you can access your account securely day or night. Online banks, credit unions and nonbank providers offer some of the best savings rates on the market while charging fewer fees than traditional banks. They also often offer good websites and mobile apps that typically let customers deposit checks and pay bills. Through its various subsidiaries, the company provided corporate and investment banking, capital market services, mortgage banking, and wealth management — with nearly 24,000 employees.

SunTrust Banks, Inc is one of the largest and strongest financial holding companies in the United States. Through its banking subsidiaries, the company provides deposit, credit, trust, and investment services to a broad range of retail, business, and institutional clients. Other subsidiaries provide mortgage banking, brokerage, asset management, and capital market services.

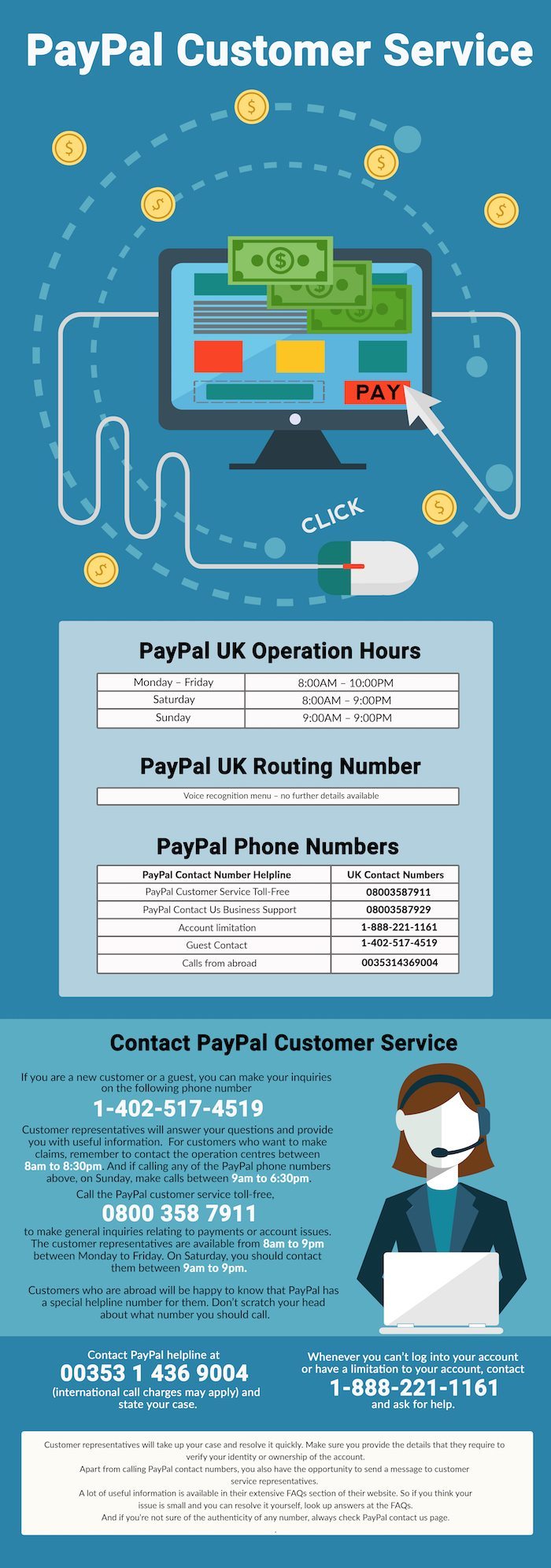

SunTrust provides customers with a full range of technology-based banking channels, including Internet, PC, and Automated Telephone Banking. SunTrust business credit cards offer credit lines up to $50,000, and cards can be linked to your business checking account to provide overdraft protection. Business credit cards can also participate in rewards programs. Here are other highly rated high-yield savings accounts. The overall rating includes multiple data points, including savings account features, customer service and app store ratings. When you're shopping for the option that fits you best, these are worth checking out.

We refresh FICO scores monthly to ensure you have the most up to date score. Log in to your online banking account, or SunTrust mobile app, select your credit card and click on "More" to access your score. Non-deposit investment products, insurance, and securities are NOT deposits or obligations of, insured or guaranteed by Associated Bank, N.A. Consult with your tax and/or legal advisor for information specific to your situation. And more access - bank from virtually anywhere with online banking and our mobile apps, designed to keep you going. High-interest savings accounts are deposit accounts from financial institutions that earn above-average yields.

Typically, the rates are also better than those offered by checking accounts. Some of the best savings interest rates come from online banks and providers. They don't have the cost of maintaining branches and are able to pass the savings on to customers with better returns. The well-known credit card company offers a savings account with no monthly fees or minimum balance requirements. Recurring payments are a great way to set up automatic monthly payments towards your credit card balance while avoiding missed or late payments. You have the choice to set your minimum monthly payment, your statement balance or a set dollar amount.

Log in to your online banking account and select the "Move Money" tab to get started. Most online financial institutions are federally insured by the Federal Deposit Insurance Corp., up to $250,000 per depositor. If the account is with a credit union, the account will likely be insured through the National Credit Union Administration, also for $250,000 per depositor. This means that if a provider were to fail and go out of business, you would not lose the money you have in the account, up to the insured amount.

Marcus by Goldman Sachs does not charge monthly fees, and there is no minimum balance required to earn interest. You'll be able to access your account through a mobile app, along with several other options. Be advised that the bank doesn't offer a checking account.

We understand our clients have unique payment preferences, which is why we offer choices to fit your lifestyle. You can choose to make payments through our mobile app, online at suntrust.com, by phone, by mail or in person with a banker or teller at any SunTrust Bank branch. You now have the freedom to choose how you would like to receive your credit card statement.

We offer free estatements for all of our SunTrust Business Credit Card accounts. Once registered, an account user can opt into estatements by going to the "Account Info" tab then clicking on "Change Statement Delivery Method" and then choosing "Receive Electronic Statement Only". You will get an email each month informing you when your statement is available to view online. Banking at the speed of you Conveniently bank 24/7 from our closest branch - your pocket. Many credit unions restrict their membership by area or employer, but Chicago-based Alliant Credit Union is different. You can apply for membership by first becoming a member of the nonprofit Foster Care to Success.

(Alliant will pay the $5 fee on your behalf.) Members can open an Alliant savings account that pays a solid rate as long as the average daily balance is $100 or more. The credit union waives the $1 monthly fee if you choose e-statements. Most online banks, credit unions and nonbank providers have slashed their rates in response to the Federal Reserve's emergency rate cuts. But the high-interest savings accounts detailed below continue to offer some of the strongest yields available. Today, you are able to receive a paper statement and view the .pdf online or via mobile. You can log into your online banking account or SunTrust mobile app to view up to seven years of statements.

Once you opt in to e-statements, the paper statements stop and then are only available online. We will e-mail you a reminder when your statement is ready to be viewed online. SunTrust Business Card Online provides an easy and secure way to view your credit card account information online. With this service you can view your account summary and transaction information and make payments, all from the convenience of your desktop.

If you have a SunTrust business checking account, you may log into Business Online to make your loan payment online. Your piggy bank just got more interesting Setting aside even small amounts of money can put you on the right track for financial fitness. Our savings accounts offer attractive interest rates without tying up your funds. The online-only company offers a couple of optional savings features.

Users have the ability to automatically transfer a portion of their paycheck into their Chime savings account. Additionally, customers can opt into a service that rounds up every Chime debit card purchase to the nearest dollar and deposits the difference into the savings account. Investment and insurance products and services including annuities are available through U.S. Bancorp Investments, Inc., member FINRA and SIPC, an investment adviser and a brokerage subsidiary of U.S. Log in to your online banking account and look for the "Rewards" section on the right side of your profile with your rewards balance. When you click on the rewards hyperlink, you will be redirected to our rewards website where you can browse through our rewards catalog, and choose several ways to redeem.

To prevent interruptions while traveling, we recommend setting a travel notification on your account. To do so, log in to your online banking account and select the "Support" tab to set up to four travel destinations. You can also log in to your SunTrust mobile app, and select "Account Services". They generally come with high APYs, high minimum deposit requirements and some check-writing privileges. Depending on the type of financial institution, you can open an account either online or in person.

You'll need to provide your Social Security number and contact information, along with at least one form of identification, such as a driver's license or a passport. (For a joint account, everyone wanting access to the account must provide this information and ID.) You will often be required to deposit money into the new account right away. You can do that by depositing cash or checks, or through a wire transfer.

Comenity Direct offers a strong savings account that has no monthly fees. You can access your account on Comenity's mobile apps, which let you transfer funds and scan and deposit checks. Read on for more details about NerdWallet's top high-yield online savings accounts. Check the bottom of the page for more information about how these financial products work. This web site is intended to be made available only to individuals in the United States. By using this site, you consent to the use of cookies which collect information about site visitors.

To continue to this site, you must acknowledge that you understand and agree to these terms of use by clicking "I Accept" below. At SunTrust, we have several credit card options to suit your needs. Below are the most frequently asked questions about our credit cards. Never share your passwords, online banking credentials or personal information over the phone, via email or text message. First Horizon Advisors is the trade name for wealth management products and services provided by First Horizon Bank and its affiliates.

NerdWallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product's site. All financial products, shopping products and services are presented without warranty. When evaluating offers, please review the financial institution's Terms and Conditions. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly.

Several years of credit history with a variety of account types such as major credit cards, installment debt , and mortgage debt if applicable. On February 7, 2019, BB&T Corporation reported that it would acquire SunTrust to create the sixth-largest US bank, with assets of $442 billion and market capitalization around $66 billion. BB&T will be the nominal survivor, but the merged bank will be headquartered in Charlotte under a new name, Truist Financial Corporation.

However, Truist will retain significant operations in Atlanta. It was subsequently announced that Atlanta will be Truist's headquarters for wholesale banking, while Winston-Salem will be the headquarters for community banking. SunTrust had been the last major bank headquartered in Atlanta, which had been the South's financial capital for much of the 20th century. Truist Securities is the trade name for the corporate and investment banking services of Truist Financial Corporation and its subsidiaries, including Truist Securities, Inc., member FINRA and SIPC. We've created these shortcuts and apps to try to help customers like you (and ourselves!) navigate the messy phone menus, hold times, and confusion with customer service, especially with larger companies. And as long as you keep sharing it with your friends and loved ones, we'll keep doing it.

SunTrust also offers business term loans and commercial mortgages. Business term loans will help fund your business projects and offer flexible payment options while our commercial mortgages provide competitive rates for buying or building facilities for your business. Getting to the bank during banker's hours isn't always in the cards. Get the same level of convenience of your local branch in your home or at your office when you bank online with the security you expect from SunTrust. Deposit and loan products are offered by Associated Bank, N.A. Loan products are subject to credit approval and involve interest and other costs. Please ask about details on fees and terms and conditions of these products.

Property insurance and flood insurance, if applicable, will be required on collateral. We offer a wide variety of personal loans and line of credit solutions with competitive interest rates. Whether it's renovating your kitchen, paying for college, or consolidating high interest debt—Fulton can help get you there. Schedule an appointment at your local financial center using our online tool. A high-interest savings account, on the other hand, typically does not come with checks, though it will still offer a strong APY. NerdWallet's guide on money market accounts can help you learn more about these products and help you decide if a money market account is a good place to stash your funds.

We rated them on criteria including annual percentage yields, minimum balances, fees, digital experience and more. People often identify opening a checking account as their next money move. The APY, or annual percentage yield, is the amount of compound interest an account earns in a year.

The calculation is based on the account's interest rate and the number of times interest is paid during the year. A savings account with the highest APY grows faster than an account with a lower yield. Be willing to look beyond the larger, well-known banks.

Many smaller institutions — including online banks and apps — feature good rates and low deposit requirements. We believe everyone should be able to make financial decisions with confidence. Bank National Association, pursuant to separate licenses from Visa U.S.A. Inc., MasterCard International Inc. and American Express. American Express is a federally registered service mark of American Express.

On that day, SunTrust Bank merged into BB&T's banking unit, Branch Banking and Trust Company, forming Truist Bank as the merged company's legal banking entity. However, the merged bank will continue to operate under the BB&T and SunTrust names until the two banks' systems are combined, a process that could take up to two years. Customers of either company will be able to use the other's ATMs without charge during the process.

Both institutions will continue to offer independent product lines for a period of time. This may include differing underwriting guidelines, product features, terms, fees and pricing. Our friendly teammates at your local SunTrust branches will be happy to walk you through their respective products. You can also learn more by contacting them at 800-SUNTRUST or SunTrust.com.

As a BB&T client, you can get overdraft protection by linking your personal checking account to another personal account. It's easy to order checks, checkbook covers, personal deposit slips and address labels through online banking. SunTrust offers a variety of personal credit cards to help everyone find the features and benefits that fit their needs. To learn more about the current rewards offered, visit /credit-cards. SunTrust offers lines of credit to finance short-term or seasonal business needs or for working capital and equipment purchases. SunTrust Online Payroll is a streamlined process for you to manage your company's payroll.

In addition to handling payments to your employees, it also calculates, files and pays all your federal, state and local payroll tax. Online Payroll is a more cost-effective way to handle your payroll needs than outsourcing to another firm. We build close, enduring relationships with our business and corporate clients. With a history of more than a century of commitment, leadership and trust; we are invested in helping our clients prosper. Real estate, banking, healthcare, the marine industry and law are the verticals that most take advantage of Virgin Trains and its programs, Lowther said.

Virgin has deals with the real estate firm CBRE, the accounting firm RSM US, the construction company Moss and a few yet-unnamed hospitals. With our easy online application, you can check your rate with no impact to your credit score. The contents of this website are for informational purposes only. Nothing on this website should be considered investment advice; or, a recommendation or offer to buy or sell a security or other financial product or to adopt any investment strategy.