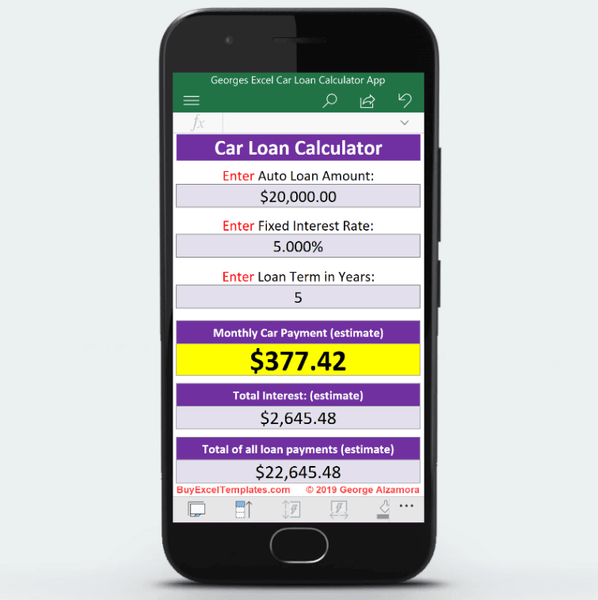

With our Auto Loan calculator, you can adjust a variety of variables for the most accurate estimate. Use the Car Loan calculator to get a sense of what kind of car, auto loan and price range you should shop for. There are a lot of benefits to paying with cash for a car purchase, but that doesn't mean everyone should do it. Situations exist where financing with an auto loan can make more sense to a car buyer, even if they have enough saved funds to purchase the car in a single payment. It is up to each individual to determine which the right decision is.

Tools like this auto loan calculator can help you get an idea. But don't forget to consider the total cost of owning a car, which can include expenses like auto insurance, fuel and maintenance. And while it may be tempting, avoid stretching out your loan term to bring down your monthly car payment. You could end up paying thousands more in interest over the life of the loan. Purchasing a vehicle usually requires a significant financial investment. Even a modestly priced vehicle—let's say $8,000 to $10,000—is more than most people can afford to pay with cash.

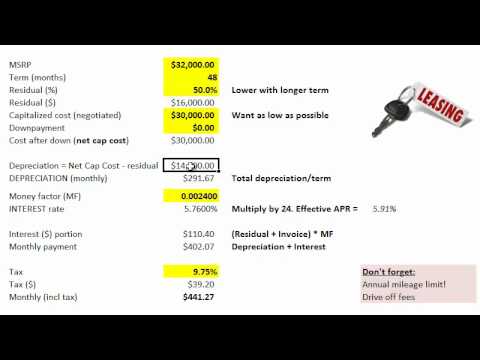

Which means most people need to take out an auto loan in order to buy a car. Your loan term -- or the amount of time you'll be paying back the loan -- will impact the price of your monthly car payments. With a shorter-term auto loan, your monthly payments will be higher, but you will have a lower APR and pay less in interest in the long-run. Use the auto loan calculator to see the difference in monthly payments and interest paid depending on the term of the auto loan. Bankrate's auto loan calculator will give you a good idea of how much car you can afford from a monthly payment standpoint. Start with a list of vehicles that you're interested in and estimated purchase prices.

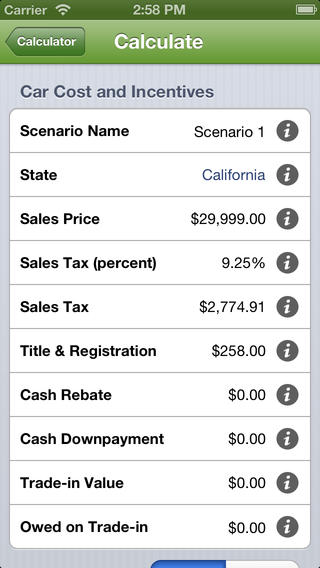

Then subtract the amount of money you can use for a down payment and an estimate of your current car's trade-in value. Lastly, compare costs to make sure that the calculated auto loan payment based on the amount you need to borrow aligns with your monthly budget. Use our auto loan calculator to estimate your monthly car loan payments. Enter a car price and adjust other factors as needed to see how changes affect your estimated payment. If the individual simply wants another car to enhance their social status, careful consideration should be given to the costs of purchasing another vehicle. In addition to the purchase price and possibility of monthly payments, insurance costs may rise.

For example, if the vehicle to be purchased is a newer model and it is financed through a bank or finance company, the owner will be required to carry full coverage insurance. With an older vehicle that is paid off, the owner may carry liability only. Not only must the owner consider the possibility of the montly payment, or a larger payment, to their existing budget, they must also consider a rise in insurance premiums. Use this calculator to help you determine your monthly car loan payment or your car purchase price. After you have entered your current information, use the graph options to see how different loan terms or down payments can impact your monthly payment.

You can also examine your complete amortization schedule by clicking on the 'View Report' button. Experts suggest that you should not allocate more than 20% of your take-home pay towards monthly auto payments. The down payment, interest rate and term of your loan will also determine how much you can afford to buy.

The best way to lower your vehicle payment is to put money down when you initiate the deal. For example, if you're buying a $20,000 vehicle, your auto loan would be for $20,000, plus whatever the interest is. But with a $4000 down payment, you'll only have to take out a $16,000 loan, plus interest.

The benefit here, aside from a lower sale price, is that you will have lower monthly payments. Try using different down payments in the car loan calculator Canada! The car loan calculator is a tool that does more than just show you a monthly car loan payment. Use it to compare lender offers and try different interest rates and loan terms.

The knowledge you gain can help you negotiate with lenders and dealers and ultimately choose the best auto loan for your financial situation. We provide the tools you need to streamline your car shopping experience, and even get pre-approved, before visiting one of our Peoria, Bloomington, or Morton locations. With a car payment calculator Illinois drivers can determine the purchase price for a new Ram 1500, a BMW X5, or a Toyota Prius. The table above isn't a guarantee of the rate you may be offered on an auto loan. Enter a total loan amount into this auto loan calculator to estimate your monthly payment, or determine your loan amount by car price, trade-in value and other factors. Buying any new or used car can get overwhelming when you have no clue of where to begin from the money standpoint.

One of the keys to a successful car purchase has always been being able to figure out what you can manage financially. So, to that end, use our car loan calculator to get an idea of what you can afford! All you have to do is plug in your desired monthly payment or your desired vehicle price.

However, most people are not prepared to pay the full purchase price in cash when they buy, financing at least some portion of the vehicle. Still, a large downpayment will minimize the loan and keep monthly payments down. For those who must finance their vehicles, taking a few months to clean up any credit problems before applying for the loan is advisable. Obtain credit reports from all three credit reporting agencies, which you can do for free at AnnualCreditReport.com. Challenge any information that is not recognized or verifiable. The company that has placed the entry on the credit report has 30 days to respond to a challenge with proof that the creditor owes them what the entry claims.

If the company does not respond within 30 days, the entry is removed from the credit report. Just like with insurance, shopping around for good loan rates will save buyers a great deal of money on their loan. The lower the interest rate, the lower the overall cost of purchasing. Better still, if the purchaser is able to pay cash, they will not need a loan. This, however, requires that the purchaser save aggressively before embarking upon the purchase. Buyers who pay in full will have the option to carry liability or full coverage insurance and the buyer will only pay the price for the vehicle.

They will pay no interest charges or fees associated with a loan. Clearly, saving in advance and paying cash is the best way to buy. Want to learn more about the estimated auto loan interest or lease payments for your new or used vehicle? Need help deciding whether to buy or lease, or whether to get financing from a bank or a dealership? We offer competitive rates on a car loan Bloomington, IL drivers can afford.

Not all auto loans are created equal, due to different financing terms. Mission Fed offers great rates and loanterms that can help your budget now and in the long run for your monthly payments. A range of factors — including your credit scores and credit history, loan amount, loan term and your down payment — can affect the interest rate your lender may offer. See the table in the next section for the average interest rates that people with different credit scores received on auto loans in the first quarter of 2021.

An auto loan calculator shows the total amount of interest you'll pay over the life of a loan. If the calculator offers an amortization schedule, you can see how much interest you'll pay each month. With most car loans, part of each payment goes toward the principal , and part goes toward interest.

Many variables, including current market conditions, your credit history and down payment will affect your monthly payment and other terms. See your local dealer for actual pricing, annual percentage rate , monthly payment and other terms and special offers. Pricing and terms of any finance or lease transaction will be agreed upon by you and your dealer.

Once credit reports are cleaned up, the buyer should shop the loan around to various banks and finance companies. With good credit, the purchaser will be more likely to obtain a low interest rate for the loan. Generally speaking, the lower the amount borrowed & the shorter the loan term, the less interest you have to pay on a loan. The auto loan calculator will display your estimated monthly auto payment. You will also see the total principal paid and the total interest paid. Add these two figures together to see the total amount you will pay for your new or used car over the life of the loan.

A car purchase comes with costs other than the purchase price, the majority of which are fees that can normally be rolled into the financing of the auto loan or paid upfront. However, car buyers with low credit scores might be forced into paying fees upfront. The following is a list of common fees associated with car purchases in the U.S. They work as any generic, secured loan from a financial institution does with a typical term of 36, 60, 72, or 84 months in the U.S. Each month, repayment of principal and interest must be made from borrowers to auto loan lenders. Money borrowed from a lender that isn't paid back can result in the car being legally repossessed.

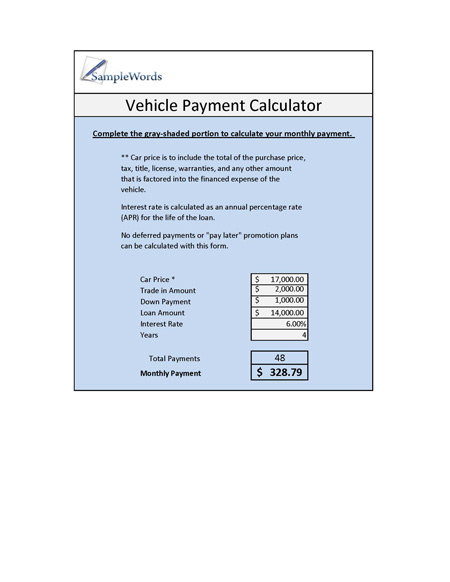

Our calculator can help you estimate your monthly auto loan payment, based on loan amount, interest rate and loan term. It'll also help you figure out how much you'll pay in interest and provide an amortization schedule . If you're planning on financing your new vehicle purchase, the overall price of the vehicle isn't really the number you need to pay attention to. Because, as our auto loan calculator will show you, the price you ultimately end up paying depends on how you structure your deal. Enter the amount you need to finance your car into the auto loan calculator. To calculate this, subtract your down payment and trade-in value amounts from your car's sticker price or MSRP.

The Auto Loan Calculator is mainly intended for car purchases within the U.S. People outside the U.S. may still use the calculator, but please adjust accordingly. If only the monthly payment for any auto loan is given, use the Monthly Payments tab to calculate the actual vehicle purchase price and other auto loan information.

The factor that will change your monthly payment the most is the loan term. The longer your loan, the less you'll pay each month, because you're spreading out the loan amount over a greater number of months. However, due to the interest you'll be paying on your loan, you'll actually end up spending more for your vehicle by the time your payments are over. Because the more time you spend paying off your loan, the more times you will be charged interest. When an individual buys a car, they are typically buying the transportation they will rely on for years to come.

For most people this is a major investment, second only to the purchase of a home. After all, few people have the resources or options to upgrade their vehicle often. The average auto loan hit a record of $31,455 in the first quarter of 2018, with the average used car loan running $19,708. Americans have over $1 trillion in motor vehicle credit outstanding.The following table from Experian shows how much people with various credit ratings typically are charged for loans. Tax, Title and Tags not included in vehicle prices shown and must be paid by the purchaser. Avoid Overbuying—Paying in full with a single amount will limit car buyers to what is within their immediate, calculated budget.

To complicate matters, car salesmen tend to use tactics such as fees and intricate financing in order to get buyers to buy out of their realm. Adjust the loan amount and loan term length on the loan payment calculator to see how it impacts your monthly payments. Auto loans have a minimum loan term of 12 months and minimum loan amount of $5,000. Use our car loan calculator to see what your monthly payment might look like—and how much interest you would pay over the life of the loan. As a business, a car loan may help you improve cash flow to your business as well as the potential to claim tax deductions if the car is being used for business purposes . Use this calculator to help you determine the monthly loan payment for your car, truck, boat, RV or motorcycle.

Enter purchase price, monthly payment, down payment, term and interest rate to see how different loan terms or down payments can impact your monthly payment. The buyer may locate a desired make and model, purchase insurance and apply for loans right from the site. Sites like TrueCar show the user the amount others have paid for the make and model they are searching for. Many people may prefer haggling over email or simply comparison shopping for a good selling price instead of haggling in person with a salesperson or a seller over their asking price. No matter the preference of the buyer, they should try to obtain the lowest selling price for the vehicle they choose. Online alternatives make the process less personal and more efficient.

Use such sites to see what others are paying for the same make and model regardless of comfort level of face-to-face haggling. Some people may simply be intimidated with the prospect of being on the seller's own turf when attempting to negotiate. Sites like CarsDirect and Truecar level the playing field and ensure that the dealer or seller is not able to influence the buyer as with a face-to-face interaction. One way to ensure you buy a quality used car is to purchase one certified by a manufacturer.

For example, Toyota offers certified vehicles at their dealerships. The certification process guarantees they are inspected and repaired, if needed. These often come with an abbreviated warranty, such as a 90 day warranty. If the purchaser has any problems during that period, they are able to return it to the dealership for repairs or replacement. Certified used cars typically cost slightly more than buying from a private individual.

However, the peace of mind resulting from purchasing certified from a reputable manufacturer or dealer gives the buyer a level of protection against a lemon. Across the industry, on average automotive dealers make more money selling loans at inflated rates than they make from selling cars. Before you sign a loan agreement with a dealership you should contact a community credit union or bank and see how they compare. You can often save thousands of dollars by getting a quote from a trusted financial institution instead of going with the hard sell financing you will get at an auto dealership.

In addition to looking at the monthly car payment result, be sure to consider the total amount you'll spend on the car loan. If you're using the calculator to compare loans, a lower payment may be appealing, but it can also result in much higher interest and overall cost. Vehicles purchased in Nebraska a $299 Doc Fee and Iowa a $179 Doc Fee will be assessed on each vehicle. Avoid Interest—No financing involved in the purchase of a car means there will be no interest charged, which will result in a lower overall cost to own the car. As a very simple example, borrowing $32,000 for five years at 6% will require a payment of $618.65 per month, with a total interest payment of $5,118.98 over the life of the loan. Credit, and to a lesser extent, income, generally determines approval for auto loans, whether through dealership financing or direct lending.

In addition, borrowers with excellent credit will most likely receive lower interest rates, which will result in paying less for a car overall. Borrowers can improve their chances to negotiate the best deals by taking steps towards achieving better credit scores before taking out a loan to purchase a car. Probably the most important strategy to get a great auto loan is to be well-prepared. This means determining what is affordable before heading to a dealership first. Knowing what kind of vehicle is desired will make it easier to research and find the best deals to suit your individual needs.

Once a particular make and model is chosen, it is generally useful to have some typical going rates in mind to enable effective negotiations with a car salesman. This includes talking to more than one lender and getting quotes from several different places. Getting a preapproval for an auto loan through direct lending can aid negotiations. The interest rate is the amount you'll pay each year to borrow money, expressed as a percentage. The interest rate is different from the annual percentage rate, or APR, which includes the amount you pay to borrow as well as any fees.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.